INTRODUCTION:

Income Tax slabs in India is often one of the most confusing areas of money management for many Indians. Words like regime, slabs, rebate, taxable income, HRA, and deductions may feel overwhelming, especially if you are filing taxes for the first time.

But once you understand income tax slabs in India, your entire tax-planning journey becomes simpler and far less stressful. This guide makes everything beginner-friendly, clear and easy to us, even if you’re new to tax filing.

What Are Income Tax Slabs in India?

India follows a progressive tax system, which means your tax rate increases as your income increases. Instead of one fixed tax rate, different income ranges are taxed at different percentages. This ensures fairness and protects lower-income earners.

Income tax plays a central role in how a country functions. Every rupee collected through taxes helps the government build infrastructure, improve healthcare, support education, develop transportation systems and run welfare programs that benefit millions of people. In India, income tax also shapes economic policies, influences investment habits and guides how individuals plan their finances throughout the year.

For many salaried individuals, income tax becomes visible only when they receive Form 16 or see TDS on their payslip. But beyond filing returns, understanding income tax helps you negotiate your salary structure better, make smarter investment choices and take advantage of benefits that reduce your long-term financial stress. Employers often offer components like HRA, LTA, food allowance, NPS contributions and reimbursements, which can reduce your taxable income if you understand how they work.

Income tax also encourages financial discipline. When taxpayers invest in retirement schemes, health coverage or long-term savings instruments, they not only reduce tax liability but also strengthen their financial security. Over time, this creates a healthier financial ecosystem for both individuals and the economy.

Having a basic understanding of how income tax supports the nation and shapes your personal finances empowers you to make thoughtful, informed decisions every year.

Slabs differ under:

– New Tax Regime

– Old Tax Regime

Let’s simplify both.

WHAT ARE INCOME TAX SLABS?

India uses a progressive tax system. As income increases, tax rates increase. Income ranges are divided into slabs, and each slab has a different tax rate.

THE NEW TAX REGIME (2024–25)

Income Range (₹) | Tax Rate

0 – 3,00,000 to 0%

3,00,001 – 6,00,000 to 5%

6,00,001 – 9,00,000 to 10%

9,00,001 – 12,00,000 to 15%

12,00,001 – 15,00,000 to 20%

Above 15,00,000 to 30%

- Key Benefit: If your income is below ₹7 Lakhs, you pay zero tax after rebate (87A).

- Best For: First-time taxpayers, People with fewer deductions and Those who want a simple structure

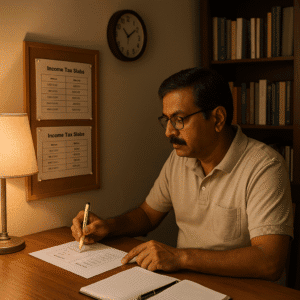

THE OLD TAX REGIME

Income Range (₹) | Tax Rate

0 – 2,50,000 | 0%

2,50,001 – 5,00,000 | 5%

5,00,001 – 10,00,000 | 20%

Above 10,00,000 | 30%

OLD VS NEW REGIME — WHICH IS BETTER?

Choose New Regime if:

– You don’t invest much

– You want a simple tax structure

Choose Old Regime if:

– You claim many deductions

– You have HRA or home loan interest

– You invest in 80C, 80D, NPS

EXAMPLE OF TAX CALCULATION

Salary: ₹9,00,000

Old Regime (with deductions): Tax ≈ ₹26,000

New Regime: Tax ≈ ₹52,500

TAX SLABS FOR SENIOR CITIZENS (OLD REGIME)

Senior Citizens (60–80 years)

- 0 – 3,00,000 → 0%

- 3,00,001 – 5,00,000 → 5%

- 5,00,001 – 10,00,000 → 20%

- Above 10,00,000 → 30%

Super Senior Citizens (80+ years)

- 0 – 5,00,000 → 0%

- 5,00,001 – 10,00,000 → 20%

- Above 10,00,000 → 30%

COMMON DEDUCTIONS IN OLD REGIME

– Section 80C: PPF, ELSS, EPF, LIC

– Section 80D: Health insurance

– Section 80CCD(1B): NPS

– Section 80G: Donations

– Section 24(b): Home loan interest

– HRA, LTA

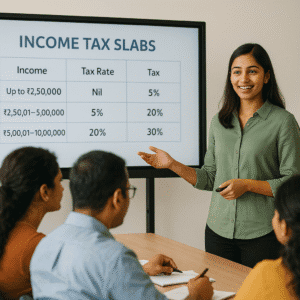

REAL-LIFE EXAMPLE

REAL-LIFE EXAMPLE

Priya earns ₹8,50,000. After deductions under Old Regime, she pays zero tax. Under New Regime, she would pay around ₹12,500. Her savings came from tax planning.

CONCLUSION

Understanding income tax slabs in India helps you make smarter money decisions. It’s not about becoming a tax expert—it’s about knowing how your income is taxed and using that clarity to save more. Choose the regime that works best for your lifestyle, your deductions and your long-term plans. Even small decisions today can create meaningful savings tomorrow.

FAQs

1. What are the income tax slabs in India?

They are income ranges with different tax percentages under Old and New Regimes.

2. Which regime is better?

Old Regime is good for deductions. New Regime is simpler.

3. Is New Regime mandatory?

No, you can choose.

4. Do senior citizens have different slabs?

Yes, under Old Regime.

5. How do I calculate taxable income?

Gross income minus deductions and exemptions.