Choosing the right bank account can feel confusing, especially when you’re just starting your financial journey. With so many banks, account types and hidden charges, it’s easy to feel overwhelmed. Many Indians simply choose the bank closest to home without checking if it truly fits their needs.

But your bank account is your financial foundation. It’s the place where your income arrives, your savings grow and your financial habits begin. Picking the right one can give you comfort, clarity and confidence. And the good news? You don’t need to be a finance expert to make the right choice.

This gentle guide will help you understand what actually matters, what to avoid and how you can choose a bank account that supports your daily life.

Why Choosing the Right Bank Account Matters More Than You Think

Your bank account affects:

- how easily you manage your money

- how much you pay in hidden charges

- how quickly you access your funds

- how safe your deposits are

- how much interest you earn

Many people realise they chose the wrong account only when they get unexpected charges or face difficulty during emergencies.

A good account quietly supports you. A wrong account slowly drains money without you noticing.

1. Understand the Main Types of Bank Accounts in India

1. Understand the Main Types of Bank Accounts in India

Before choosing the right bank account, it helps to know the basic options:

Savings Account

Ideal for salary earners and beginners. Offers moderate interest, debit card, UPI access and online banking.

Salary Account

Provided by employers. Zero balance, but converts into savings account if salary stops.

Current Account

For business owners and freelancers. Higher limits, but no interest.

Zero-Balance Account

Perfect for students and new earners. No minimum balance requirement.

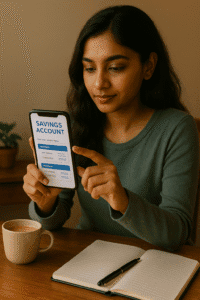

Digital-Only Accounts

Offered by banks like Kotak 811, SBI YONO, Fi Money. Fully online, quick setup, modern features.

Once you understand your lifestyle, it becomes easier to choose.

2. Check the Safety of the Bank (This Should Be Your First Criteria)

Safety matters more than features.

Look for:

- RBI-approved scheduled commercial banks

- Well-established public and private sector banks

- Deposit insurance (DICGC) coverage up to ₹5 lakh

Banks like SBI, HDFC, ICICI, Axis, Bank of Baroda and even most small finance banks follow strict RBI guidelines.

A safe bank protects both your money and your peace of mind.

3. Compare Minimum Balance Requirements

This is where many Indians unknowingly lose money.

- Some accounts require ₹2,000

- Some require ₹5,000

- Some even require ₹10,000+

If your balance falls below the minimum, the bank charges penalties.

General rule: Choose an account with a minimum balance that feels comfortable for your income level and lifestyle.

If you want zero stress, choose a zero-balance account or digital account.

4. Look for Transparent Charges (Most People Skip This Step)

4. Look for Transparent Charges (Most People Skip This Step)

Banks charge for:

- ATM withdrawals beyond limit

- SMS alerts

- Debit card types

- Cheque books

- Branch cash deposits

- Non-maintenance of balance

These charges add up quietly.

Before choosing the right bank account, check the bank’s “Schedule of Charges” on its website. This will save you from surprise deductions.

5. Compare ATM & Branch Accessibility

If you withdraw cash often or prefer in-person help, choose a bank with:

- nearby branches

- plenty of ATMs

- easy customer support

If you rarely visit the bank, a digital-first bank might be better.

Your lifestyle decides what “convenience” means to you.

6. Check Online Banking & Mobile App Quality

6. Check Online Banking & Mobile App Quality

In India, smooth banking apps make life easier.

A good app should allow:

- UPI payments

- quick transfers

- fixed deposits

- statement downloads

- card control features

- branch-free customer service

Banks like HDFC, ICICI, SBI YONO, Kotak 811 and Axis offer strong digital experiences.

7. Look at Interest Rates, But Don’t Make It Your Only Factor

Some small finance banks offer higher interest on savings accounts, like 5–7%.

But focus on:

- safety

- stability

- hidden fees

- convenience

Interest is helpful, but not everything.

8. Consider Your Future Needs

Ask yourself:

- Will my income grow soon?

- Will I need a joint account?

- Will I apply for a credit card later?

- Will I travel often?

- Do I need international transactions?

Choosing the right bank account means picking one that grows with you.

Conclusion

Choosing the right bank account in India doesn’t have to be confusing. When you understand your needs — safety, convenience, charges and features — the decision becomes simple and empowering. The right account gives you clarity, supports your lifestyle and helps you feel more in control of your money.

Take a moment today to reflect on what you need from your bank. One small decision can bring you years of peace and financial confidence.

FAQs

1. How do I choose the right bank account in India?

Compare safety, minimum balance, charges, features and convenience based on your lifestyle.

2. Which bank account is best for beginners?

A zero-balance digital savings account is great for new earners and students.

3. What documents do I need to open a bank account?

Aadhaar, PAN, address proof and a passport-size photo. KYC is mandatory.

4. Are digital bank accounts safe in India?

Yes, as long as the bank is regulated by the RBI and offers DICGC deposit insurance.

5. Should I choose a bank with high interest rates?

Interest helps, but safety, charges and convenience matter more.