-

Table of Contents

Introduction

Understanding insurance and tax basics are essential for individuals in India to protect themselves financially and comply with legal requirements. In this guide, we will provide an overview of insurance and tax concepts for beginners, including the types of insurance available, how insurance works, and the basics of taxation in India. By gaining a better understanding of these topics, individuals can make informed decisions to safeguard their financial well-being and ensure compliance with tax laws.

How to Choose the Right Insurance Plan and Tax Saving Options in India

How to Choose the Right Insurance Plan and Tax Saving Options in India

Insurance and taxes are two important aspects of financial planning that every individual should be aware of. In India, understanding the basics of insurance and tax can help you make informed decisions that can protect your financial future. In this article, we will discuss how to choose the right insurance plan and tax-saving options for beginners in India.

When it comes to insurance, there are several types of policies available in the market, such as life insurance, health insurance, and general insurance. Life insurance is a crucial component of financial planning as it provides financial security to your loved ones in case of your untimely demise. Health insurance, on the other hand, covers medical expenses in case of illness or accidents. General insurance includes policies like car insurance, home insurance, and travel insurance, which protect your assets from unforeseen events.

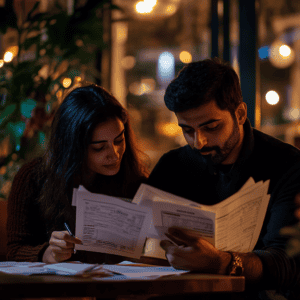

Before choosing an insurance plan, it is essential to assess your needs and financial goals. Consider factors like your age, income, dependents, and liabilities to determine the type and amount of coverage you require. It is advisable to consult with a financial advisor or insurance agent to understand the various options available and select a plan that best suits your requirements.

When it comes to taxes, there are several ways to save money by taking advantage of tax-saving options provided by the government. One of the most popular tax-saving instruments in India is the Public Provident Fund (PPF), which offers tax benefits under Section 80C of the Income Tax Act. Investing in PPF not only helps you save taxes but also provides long-term returns on your investment.

When it comes to taxes, there are several ways to save money by taking advantage of tax-saving options provided by the government. One of the most popular tax-saving instruments in India is the Public Provident Fund (PPF), which offers tax benefits under Section 80C of the Income Tax Act. Investing in PPF not only helps you save taxes but also provides long-term returns on your investment.

Another tax-saving option is investing in Equity Linked Savings Schemes (ELSS), which are mutual funds that invest in equity markets. ELSS offers tax benefits under Section 80C and has the potential to generate higher returns compared to traditional tax-saving instruments like Fixed Deposits or National Savings Certificates.

Apart from PPF and ELSS, you can also save taxes by investing in National Pension System (NPS), which is a voluntary retirement savings scheme regulated by the government. NPS offers tax benefits under Section 80CCD and allows you to build a retirement corpus that can provide financial security in your golden years.

In addition to investments, you can also save taxes by claiming deductions on expenses like home loan interest, medical insurance premiums, and education loan interest. By keeping track of your expenses and investments, you can maximize your tax savings and reduce your tax liability.

In conclusion, insurance and taxes are essential components of financial planning that can help you secure your future and save money. By understanding the basics of insurance and tax-saving options in India, you can make informed decisions that align with your financial goals. Consult with a financial advisor or tax consultant to explore the various options available and choose the right plan that suits your needs. Remember, a well-thought-out financial plan can provide peace of mind and financial security for you and your loved ones.

Understanding Tax Basics for Beginners in India

Insurance and taxes are two important aspects of personal finance that every individual should be aware of. In India, understanding the basics of insurance and taxes can help individuals make informed decisions and plan their finances effectively. In this article, we will discuss the fundamentals of insurance and taxes for beginners in India.

Insurance and taxes are two important aspects of personal finance that every individual should be aware of. In India, understanding the basics of insurance and taxes can help individuals make informed decisions and plan their finances effectively. In this article, we will discuss the fundamentals of insurance and taxes for beginners in India.

Insurance is a financial product that provides protection against financial losses. There are various types of insurance policies available in India, including life insurance, health insurance, vehicle insurance, and property insurance. Life insurance provides financial security to the policyholder’s family in case of the policyholder’s death. Health insurance covers medical expenses in case of illness or injury. Vehicle insurance provides coverage for damages to the insured vehicle, while property insurance protects against damages to the insured property.

When purchasing an insurance policy, it is important to understand the terms and conditions of the policy, including the coverage amount, premium amount, and claim process. It is advisable to compare different insurance policies from different insurance companies to find the best policy that suits your needs and budget. Additionally, it is important to review and update your insurance policies regularly to ensure that you are adequately covered.

Taxes are mandatory financial contributions imposed by the government on individuals and businesses to fund public services and infrastructure. In India, taxes are levied by the central government, state governments, and local bodies. The two main types of taxes in India are direct taxes and indirect taxes. Direct taxes are taxes that are directly paid by individuals or businesses to the government, such as income tax, corporate tax, and wealth tax. Indirect taxes are taxes that are levied on goods and services, such as goods and services tax (GST), customs duty, and excise duty.

Income tax is a direct tax levied on the income of individuals and businesses. The income tax rates in India vary based on the income slab of the taxpayer. Individuals are required to file their income tax returns annually to declare their income and pay the applicable taxes. It is important to keep track of your income and expenses throughout the year to ensure accurate filing of income tax returns.

Goods and services tax (GST) is an indirect tax levied on the supply of goods and services in India. GST has replaced multiple indirect taxes such as service tax, value-added tax (VAT), and central excise duty. GST rates vary based on the type of goods and services. Businesses are required to register for GST and file GST returns regularly to comply with the GST regulations.

Understanding the basics of insurance and taxes is essential for financial planning and management. By being aware of the different types of insurance policies and taxes in India, individuals can make informed decisions and take steps to protect their financial interests. It is advisable to consult with a financial advisor or tax consultant for personalized advice on insurance and tax planning. By staying informed and proactive, individuals can ensure financial security and compliance with tax regulations in India.

Importance of Insurance for Beginners in India

Insurance and taxes are two important aspects of financial planning that every individual should be aware of. In India, understanding the basics of insurance and taxes is crucial for beginners to ensure financial security and compliance with the law. In this article, we will discuss the importance of insurance for beginners in India and provide an overview of tax basics that every individual should be aware of.

Insurance and taxes are two important aspects of financial planning that every individual should be aware of. In India, understanding the basics of insurance and taxes is crucial for beginners to ensure financial security and compliance with the law. In this article, we will discuss the importance of insurance for beginners in India and provide an overview of tax basics that every individual should be aware of.

Insurance plays a vital role in providing financial protection against unforeseen events such as accidents, illnesses, or natural disasters. For beginners in India, having insurance coverage can help mitigate financial risks and provide peace of mind. There are various types of insurance policies available in the market, including life insurance, health insurance, vehicle insurance, and property insurance. It is essential for beginners to assess their insurance needs and choose the right policies that suit their requirements.

Life insurance is one of the most common types of insurance that beginners in India should consider. Life insurance provides financial protection to the policyholder’s family in case of the policyholder’s untimely demise. It can help cover expenses such as funeral costs, outstanding debts, and provide financial support to the family members. Health insurance is another crucial insurance policy that beginners should have. Health insurance can help cover medical expenses in case of illness or accidents, ensuring that individuals do not have to bear the financial burden of healthcare costs.

Vehicle insurance is mandatory in India for all vehicle owners. Having vehicle insurance can protect individuals from financial losses in case of accidents, theft, or damage to the vehicle. Property insurance is essential for homeowners to protect their property from risks such as fire, theft, or natural disasters. Having property insurance can provide financial security and peace of mind to homeowners.

In addition to insurance, understanding the basics of taxes is essential for beginners in India. Taxes are levied by the government on individuals’ income, property, goods, and services to fund public services and infrastructure. Every individual in India is required to pay taxes based on their income and assets. There are various types of taxes in India, including income tax, goods and services tax (GST), property tax, and wealth tax.

Income tax is a direct tax levied on individuals’ income earned during a financial year. Individuals are required to file their income tax returns annually and pay taxes based on their income tax slab rates. Goods and services tax (GST) is an indirect tax levied on the supply of goods and services in India. GST has replaced multiple indirect taxes such as service tax, excise duty, and value-added tax (VAT), simplifying the tax system in India.

Property tax is a tax levied by local authorities on property owners based on the value of their property. Property tax is used to fund local services such as sanitation, roads, and infrastructure development. Wealth tax is a tax levied on individuals’ net wealth, including assets such as property, investments, and jewelry. However, wealth tax has been abolished in India since 2015.

In conclusion, insurance and taxes are essential aspects of financial planning that beginners in India should be aware of. Having insurance coverage can provide financial protection against unforeseen events, while understanding tax basics can help individuals comply with the law and manage their finances effectively. By being informed about insurance and taxes, beginners can ensure financial security and stability in the long run.

Conclusion

Understanding insurance and tax basics is crucial for beginners in India to protect their assets and comply with legal requirements. By learning about different types of insurance policies and tax regulations, individuals can make informed decisions to safeguard their financial well-being. It is important to consult with financial advisors or experts to ensure proper coverage and compliance with tax laws. Taking the time to educate oneself on insurance and tax basics can ultimately lead to better financial planning and security in the long run.